In April 2025, President Donald Trump imposed taxes on foreign imports, causing financial market turbulence and raising concerns about the impact on the US economy. Despite the market’s unfavorable reaction, President Trump stayed firm, comparing the situation to a medical treatment and said, “Sometimes you have to take medicine.”

The Tariffs and Their Immediate Impact

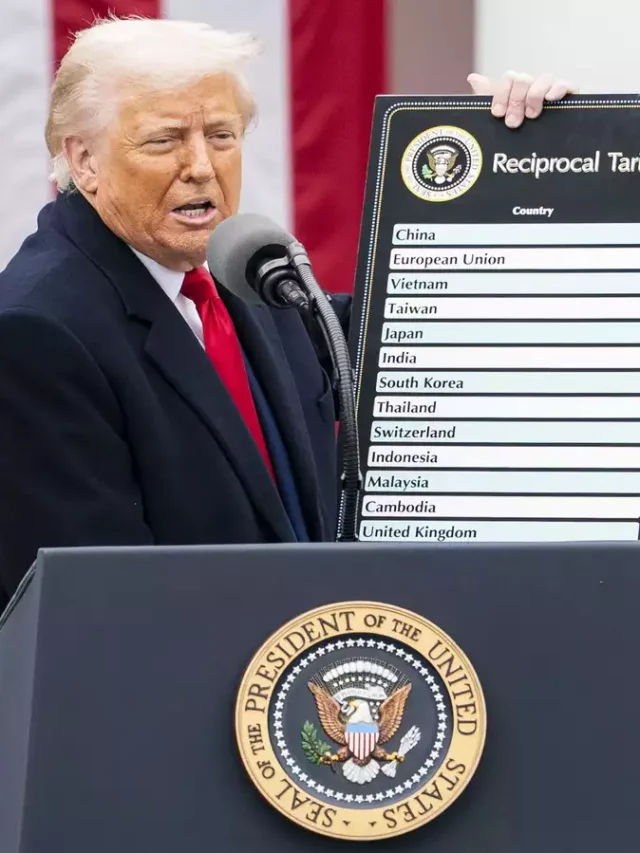

On April 2, 2025, dubbed “Liberation Day” by the administration, President Trump placed a baseline 10% tax on all international imports, with higher rates targeting individual countries: 34% on Chinese goods, 20% on European Union items, 24% on Japanese imports, and 32% on Taiwanese goods. This bold step was intended to minimize the trade imbalance and strengthen domestic production.

In the immediate aftermath, world markets fell precipitously. The S&P 500 fell 10% in two days, entering bear market territory. The Dow Jones Industrial Average dropped about 4%, one of its worst single-day point losses. International markets followed suit, with Japan’s Nikkei 225 down 2.8% and Europe’s FTSE 100 down 1.6%.

Economic Concerns and Recession Fears

The onset of stagflation, which is characterized by slow economic growth and soaring prices, was a major source of concern. Tariffs caused a supply shock, raising manufacturing costs and consumer prices while discouraging investment and expenditure. The Yale Budget Lab predicted a 2.3% inflation increase in 2025, potentially costing the typical US household $3,800.

Economists and financial experts voiced great fear that the tariffs may plunge the United States into a recession. JPMorgan boosted the chance of a recession in 2025 to 60%. BlackRock CEO Larry Fink stated that the majority of CEOs he contacted felt the United States was already in a recession, underscoring the broad concern in the business sector.

Corporate Responses and Market Sentiment

Corporate executives expressed concerns about the tariffs’ impact. Bill Ackman, a billionaire investor, has warned that failing to suspend the tariffs might result in “economic nuclear war,” hurting global ties and investment. Boaz Weinstein of Saba Capital compared the scenario to the circumstances preceding the Great Depression, expecting market volatility and bankruptcy.

President Trump maintained optimism, claiming that the market and economy will prosper in the long term. He likened the situation to a necessary medical operation, claiming that the United States was like a patient recovering after successful surgery.

He stressed the opportunities for investment and his openness to talk with other countries. Despite the market’s unfavorable reaction, President Trump stayed firm, comparing the situation to a medical treatment and said, “Sometimes you have to take medicine.”

Global Reactions and Trade Relations

The tariffs elicited immediate worldwide reactions. China put 34% punitive tariffs on US imports, raising trade tensions. European and other worldwide markets responded badly, with key indexes falling sharply.

Analysts warned that these protectionist policies would destabilize the post-World War II global trade system, with long-term economic ramifications. Critics warned that the administration’s strategy endangered deindustrialization in impacted nations and slowed global economic development.

Potential Long-Term Implications

The long-term consequences of the tariffs remained unknown. While the government sought to revitalize American businesses and lower the trade deficit, economists cautioned against possible consequences. Tariffs might increase consumer costs, disrupt supply networks, and strain international relations. The potential of extended stagflation exacerbated the economic picture.

Conclusion

President Trump‘s implementation of massive tariffs in April 2025 caused immediate market turbulence and sparked serious fears about the US economy’s future. While the government argued that these policies were required for long-term economic health, the immediate consequences included market falls, recession worries, and strained foreign ties. The entire impact of these tariffs is still to be known, but they have definitely set the stage for a complicated economic picture in the next months and years.